Ftx Killed Bitcoin

DISCLAIMER: THE AUTHOR OF THIS ARTICLE IS A TOXIC BITCOIN MAXIMALIST, IF YOU DO NOT LIKE THAT, I SUGGEST YOU READ THIS ARTICLE INSTEAD.

Recently, FTX, the world’s (formerly) third-largest crypto exchange, declared bankruptcy. I won’t be recounting the entirety of the events that unfolded (since they’re way too complicated), but I will link to some resources (here and here) that do for the reader’s convenience as I summarize the events.

The story seemingly started a while back, but the trigger for the fallout could be attributed to one Tweet from CZ of Binance saying Binance would be liquidating all of their held FTT token (FTT is FTX’s exchange token). This triggered a bank run on FTX and caused massive losses for them. This resulted in a cascade of contagion as other lenders and holders of FTT bags were taking losses and being margin called on leverage (this happens when the collateral you put up for a loan devalues below the value of the loan). In the ensuing fallout, several other exchanges and crypto institutes paused transactions and withdrawals as the mess unfolded; some indicated preparations for bankruptcy. As the world watched crypto contagion unfold again this year (the Luna/Terra collapse was the previous event), other strange things began occurring at FTX: funds started leaving FTX and were being mixed and sent elsewhere. While this summary barely scratches the surface of the whole story involving FTX, Ukraine, the Democratic Party, and Tom Brady, the author believes that the second and third-order effects are still being played out. One of these effects is the death of Bitcoin.

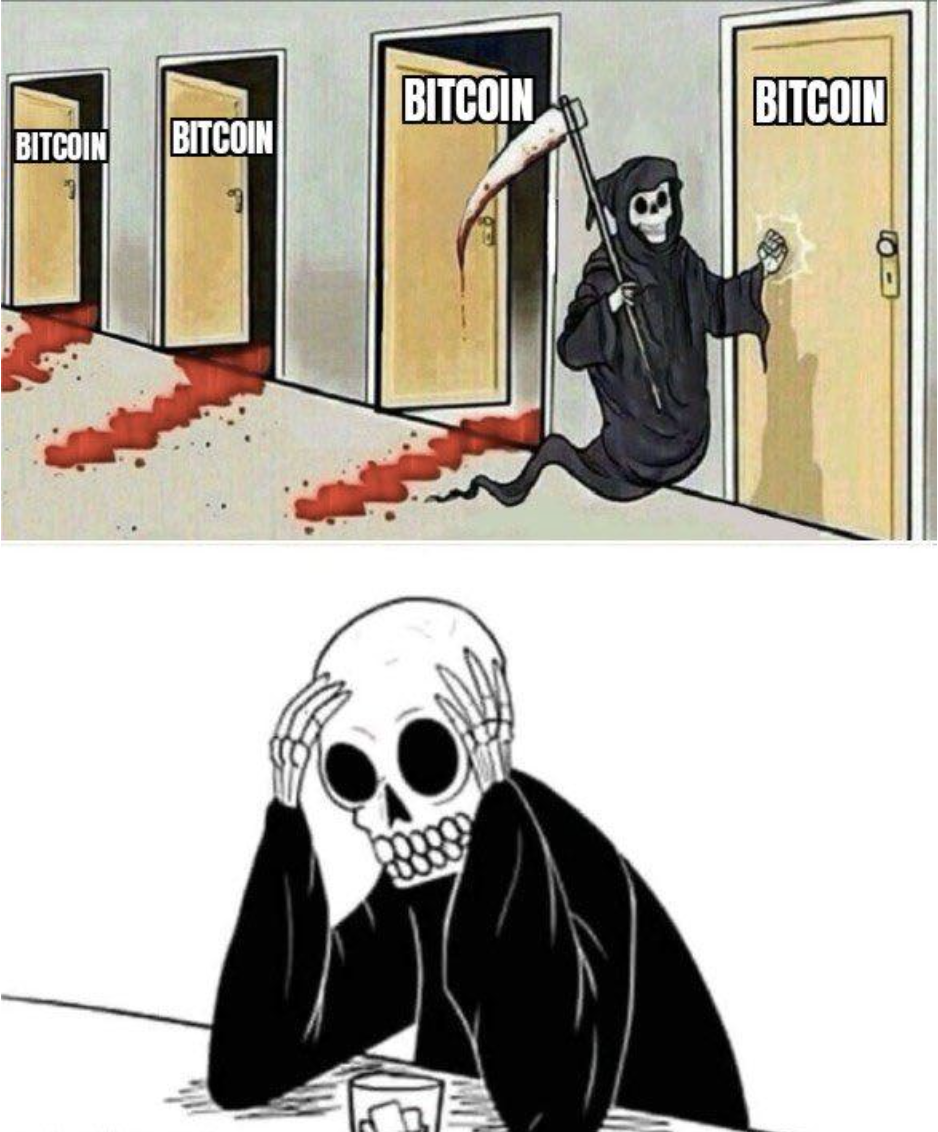

Just kidding. Bitcoin didn’t die, again.

Bitcoin has been pronounced dead over 400 times but still holds the highest market cap of any digital crypto asset with the widest adoption and usage. The rest of this article will begin to outline the difference between Bitcoin and crypto but is far from a complete guide.

To start, one of the biggest differences is the lack of central identity or control for Bitcoin. There is no Bitcoin CEO or Bitcoin marketing team. There are just thousands, maybe millions, of individuals voluntarily participating in the network. There is no one for Congress to call to a session to question about Bitcoin. There is no regulatory body that can crack down on Bitcoin. The State can only attack Bitcoin-related companies and entities, which unfortunately happens in many countries around the world. For instance, in 2021, China banned crypto and Bitcoin. This took their geographic location from being number 2 in the world for mining power to 0. China is again one of the top regions for Bitcoin mining by hash power. This censorship resistance is a feature of Bitcoin that many in the Western world have a hard time appreciating.

The Price!

The price went way down… again. Price volatility is another common complaint for Bitcoin but it’s hard to price something with an ever-moving measuring stick (aka the US dollar). With the recent FTX collapse, many impacted companies had to resort to selling assets to cover losses and fill balance sheet holes. What is one of the highest valued and most salable asset these companies were holding? Bitcoin. So as Bitcoin was being sold off to cover over-leveraged positions, the price tanked. It dropped from around the $20k range to ~$16k. Pretty big drop, but relative to what? Some of the crypto tokens caught in this FTX blow-up went to 0 or near 0. The venture capital fund Sequoia’s investment into FTX went to 0 with little recourse to recover, as FTX’s balance sheet was full of liabilities, but severely lacking assets. Even with the drawdown in price, a Bitcoin hodler that simply bought and held sats (satoshis) performed better than someone gambling on FTX’s success. This is a common pattern when comparing crypto assets to Bitcoin. Self-custodial Bitcoin is an asset that isn’t anyone else’s liability and lacks counter-party risk. Third parties might influence the perceived value of self-custodial bitcoin but cannot take it from you (except for the $15 wrench attack, but humans are always the least secure part of a system).

Utility

“Bitcoin doesn’t really do anything, it’s so boring and not useful.” This is true, but boring money is good money. And the one thing it set out to do is be the hardest money known to man outside the control of the State. Separation of Money and State. Bitcoin does this very well. It does not have a lot of wizbang features like many crypto tokens do, but that’s OK, it just needs to be money. Albeit, censorship-resistant, definitively scarce, engineered, permissionless, decentralized, borderless, divisible, programmable money. There are many awesome and novel use cases for crypto, as with any other new technology projects, and crypto will likely solve some challenging problems, but those problems pale in comparison to the effect of sound money on the human race. As a Libertarian, you likely already have a basic understanding of how our current monetary system is broken, as viewed through an Austrian Economics lens. Now imagine a world where the money isn’t broken. Where the incentives align with net producers and not with parasitic politicians and Deep State bureaucrats. Imagine the road to wealth just involves providing goods or services to others in a voluntary system and then saving anything in excess of your needs and wants. Imagine those savings didn’t have to be handed over to a financial professional to read the tea leaves of technical analysis charts to determine the best way for your portfolio to beat inflation and/or everyone else’s portfolio. Your savings just naturally grow in value over time without having liabilities outside your control. You work your butt off to accumulate 1% of the total Bitcoin (21 million fixed cap, guaranteed by cryptographic math) and that percentage never changes unless you will it to do so.

When our whole lives are measured in money, it’s hard to ignore the importance of sound money. As it stands today, the author believes Bitcoin is the soundest money humans have known. But don’t trust the author, it would be against the Bitcoin ethos.

Don’t trust, verify.

Thank you for reading.

For more mediocre takes on Bitcoin and other topics, feel free to follow me on Twitter @garyKrause_.

This post was originally publsihed in a newsletter from the Libertarian Party of Northern Virginia and can be found in it’s original (poorly spelled before Grammarly form) here.